Poverty is a major issue that has been around us for generations.

It is a tough challenge to overcome and it often boils down to our bad financial habits.

Making a few mistakes can keep you away from achieving financial freedom.

It is important to have a look at the habits that prevent you from investing and getting good with our finances.

While some expenses are okay if you can afford them, cutting back on unnecessary spending is essential for those struggling financially.

Ever notice how small purchases can really add up or big buys go unused? It is important to quickly ditch these habits that drain your wallet.

After all, you have earned your money and should be able to enjoy it without stressing about making it to the next payday.

Let’s get started.

21 Habits That Will Make You Poor

1. Lack of Budgeting

Not budgeting is a common financial mistake.

A zero-based budget, where every dollar is allocated, can prevent frivolous spending and help you manage your finances better.

It is important to have a buffer for unexpected costs and to regularly update your budget to stay on top of your finances.

This habit is foundational for financial literacy and reaching your financial goals.

2. Overspending Habit

Spending more than you earn is unsustainable.

If your expenses consistently outstrip your income, it’s time to reassess your budget or find ways to increase your earnings.

Balancing your budget is key to financial stability.

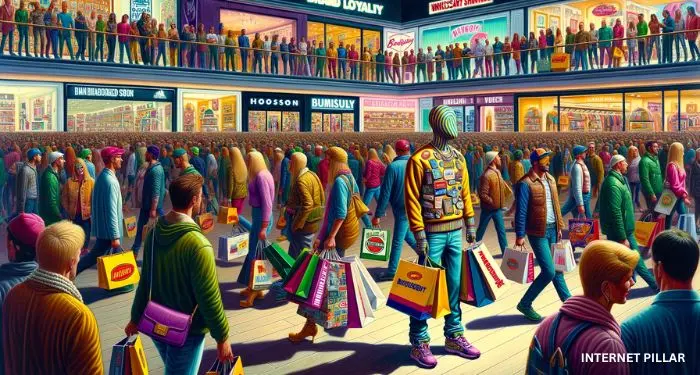

3. Impulse Purchases

Impulse buying can derail your budget.

To combat this, make a shopping list and commit to sticking to it, rewarding yourself for doing so within budget.

Being aware of your spending triggers, like outings with friends or shopping sprees, can help you control your spending habits.

4. Ignoring Credit Card Debt

Credit card debt can accumulate quickly and burden you with high interest payments.

If you’re only making minimum payments, consider debt consolidation options to manage this better.

Be cautious not to accrue more charges post-consolidation.

5. Not Automating Savings

Utilizing automatic savings can harness the power of compounding interest.

By distributing your income across spending, saving and investing accounts and automating contributions, you ensure consistent savings growth and take advantage of investment opportunities.

6. Not having a Emergency Savings

Lacking an emergency fund can put your financial stability at risk during unforeseen events.

Aim to save a portion of your income regularly to build a fund that covers several months of living expenses.

7. Not Investing

While saving is essential, especially for emergencies, investing is important for wealth growth.

Investing your money in various assets can offer returns that outpace inflation, contributing to long-term financial security.

8. Not Investing in Personal Growth

Successful individuals prioritize personal development and continuous learning.Achieving true financial security is about more than just money; it’s about having the skills and resilience to overcome any challenge.

9. Smoking and Excessive Drinking

Smoking and excessive drinking have well-documented health risks, which can also lead to significant financial costs.

While moderate alcohol consumption can be part of a balanced lifestyle, addiction to smoking or alcohol can drain finances and impact health.

10. Gambling

Gambling and purchasing lottery tickets can lead to financial ruin. Stories of individuals accumulating debt due to gambling are common.

Instead of chasing instant wealth through gambling, investing savings can offer a more reliable path to financial security.

11. Consumer Debt

Consumer debt, including credit card debt and loans for non-essential items, can be detrimental to financial health.

It is advisable to live within one’s means and avoid debt, with the exception of some essential loans like mortgages.

12. Commuting while you can walk

For short distances, walking instead of using transportation services can save money and provide health benefits.

It is an easy way to cut expenses and improve physical well-being.

13. Not having Balance in Spending

While it’s important to be frugal, excessively depriving oneself can harm well-being.

It is vital to find a balance that allows for enjoyment while staying within a budget.

14. Moving Out Too Soon

Staying with parents after education can provide a financial head-start, allowing for significant savings and investment opportunities.

This strategy can lead to substantial financial gains compared to moving out immediately.

15. Not Understanding Your Income and Expenses

It’s essential to understand where your money is going.

Using budgeting tools can help you in tracking your earnings and expenses, allowing you to manage your finances effectively.

Knowing your financial flow enables smarter spending and saving decisions.

16. Avoiding Financial Discussions

Talking about money can be daunting, but it’s important for financial growth.

Engaging in conversations about salaries, family finances and seeking advice can uncover opportunities and prevent financial missteps.

17. Avoiding Financial Literacy

A lack of financial education can lead to costly mistakes.

Investing time in learning about finance fundamentals, such as investments and taxes can enhance decision-making and financial well-being.

18. Not having Insurance

Insurance is a critical safety net for life’s uncertainties.

Skipping on essential coverage like health or property insurance can lead to significant financial strain during unexpected events.

19. Emotional Financial Decisions

Emotions can cloud financial judgment, leading to poor decisions like impulsive buying or panic selling.

It’s important to approach financial decisions calmly and seek professional advice when needed.

20. Brand Loyalty

Excessive brand loyalty can be expensive.

Regularly comparing options for services and products can uncover savings without sacrificing quality.

Being open to alternatives can stretch your budget further.

21. Not Focusing on more Earning Sources

While managing expenses is important, increasing your income has a greater impact on financial growth.

Upskilling, seeking better job opportunities, or starting a side hustle can significantly boost your financial position.

These were some of the the habits which will make you poor. You can avoid them for a financially healthy future.