Being smart with your money is a important for financial independence. Often, we don’t realize how small, frequent purchases drain our funds.

It is important to understand “if you are overspending” and take steps to improve.

On the bright side, cutting back on certain items like bottled water, fast fashion and online subscriptions can significantly boost your savings without sacrificing happiness or quality of life.

This post suggests you to make minor adjustments to your spending habits for substantial long-term savings.

Following these changes can help you to use your money more effectively.

Let’s get started.

15 Things You Should Stop Buying to Make More Money

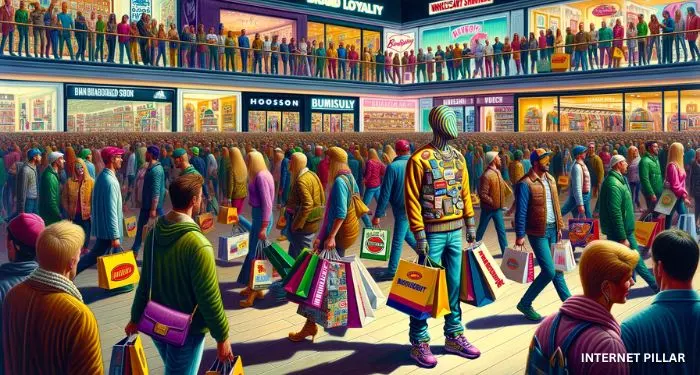

1. Branded Things

Big-name brands like Gucci and Versace carry hefty price tags, largely due to their iconic status. However, splurging on these brands isn’t a necessity.

Opting for more affordable alternatives, including thrift stores, can lead to significant savings without compromising on style.

The allure of designer labels often lies in their prestige rather than their quality.

Embracing lesser-known brands can offer comparable quality at a fraction of the cost, fostering a more sustainable spending habit.

2. Magazines

While magazines may seem like a harmless indulgence, their costs can add up, impacting your savings.

The temporary satisfaction magazines offer rarely justifies their expense.

In today’s digital age, many resources are available for free online, making physical magazines an unnecessary luxury for those looking to economize.

3. Bottled Water

Disposable plastic water bottles are not only detrimental to the environment but also an avoidable expense.

Investing in a reusable water bottle and tapping into the convenience of refillable tap water can save money and contribute to environmental conservation.

4. Latest Technology

The allure of the latest smartphones can tempt even the most prudent spender.

However, constantly upgrading to the latest model is a surefire way to strain your finances.

Prioritizing need over want and resisting the urge to follow tech trends can help maintain a healthy bank balance.

5. Buying to Impress Others

The desire to impress can lead to unnecessary purchases, harming your financial well-being.

Buying items to showcase a certain lifestyle or status, especially when they’re not needed, can derail your financial goals.

Focusing on personal needs rather than external perceptions is key to maintaining financial health.

6. Fast Fashion

Fast fashion’s appeal lies in its affordability and trendiness, but its environmental and ethical implications are considerable.

Investing in quality pieces, exploring second-hand options and maintaining your wardrobe can save money and reduce your environmental footprint.

7. Unnecessary Subscriptions

Cable subscriptions and other recurring payments can quickly become a significant expense.

Evaluating the necessity of these subscriptions and exploring alternatives like streaming services can lead to considerable savings.

Regularly reviewing and adjusting your subscription services ensures you only pay for what you truly enjoy and use.

8. Dining Out

Frequent restaurant visits can drain your wallet faster than you might think.

Cooking at home is a wallet-friendly alternative that not only saves money but can also lead to healthier eating habits.

Meal prepping and bulk shopping are effective strategies for reducing food expenses.

Setting limits on dining out can help you enjoy the experience without compromising your budget.

9. Impulsive Online Shopping

The ease of online shopping can lead to impulsive buys that strain your finances.

Retailers use tactics like flash sales to entice shoppers, making it hard to resist.

To combat this, set a clear budget for online purchases and consider a cooling-off period before finalizing any buy.

This approach helps ensure that your purchases are thoughtful and necessary.

10. Vending Machine Food

Vending machines offer instant gratification but at a higher price point.

Planning ahead by packing snacks and drinks can help you avoid these unnecessary expenses.

Simple steps like carrying a reusable water bottle or keeping snacks on hand can lead to significant savings over time.

11. Extended Warranties

Extended warranties may seem like a wise investment, but they often duplicate existing manufacturer coverage.

Before opting for an extended warranty, evaluate the cost against potential repair expenses.

In many cases, you might find that the warranty isn’t worth the additional cost.

12. Grocery Shopping Everyday

Frequent trips to the grocery store can lead to unplanned purchases and overspending.

A more effective approach involves planning your shopping trips and sticking to a list.

This not only helps with budgeting but also ensures that you’re buying only what you need.

13. Books in Hardcopy

While traditional books have their charm, they can take up space and contribute to clutter.

Digital platforms like Kindle offer a space-saving and cost-effective alternative for avid readers.

Services like Amazon Unlimited can provide access to a vast library of titles at a fraction of the cost of physical books.

14. Gym Memberships

Gym memberships are beneficial for those who use them regularly.

However, if your visits are sporadic, you might be wasting money.

Exploring alternative fitness options or reevaluating your gym usage can help you decide whether to maintain or cancel your membership.

15. Decorative Items

Decorative items can add personality to your space, but they can also accumulate and become clutter.

Being selective about these purchases can help you maintain a tidy home and avoid spending on items that don’t add significant value to your life.

So these were the things you should stop buying to make more money.