Building wealth is a common goal but it can be daunting to achieve.

Starting early improves your chances of success.

Some of the key wealth-building principles include setting goals, investing in education, managing debt, saving, investing, asset protection, understanding taxes and building credit.

Billionaires comprising only 0.003% of the population share common principles in their paths to success.

While there’s no one-size-fits-all formula they stress concepts instrumental to wealth creation.

The widely accepted notion involves spending less than earning and wise investing. However personal behavior and investment biases often pose obstacles.

Wealth creation impacts various aspects of life necessitating financial discipline through saving, budgeting, investing and wise spending.

It’s a lifelong process beyond income emphasizing essential habits for long-term financial security.

15 Key Principles of Wealth Building You Should Know

1. Earn Money

Getting started with building wealth begins with earning money.

Whether you’re just starting or looking for ways to increase your income consider two primary sources: earned income from your job and passive income from investments.

Before you can dive into the world of investments you’ll need to secure a stable earned income.

2. Setting Clear Financial Goals

Establishing clear specific financial goals in life is important.

Think about what you want to achieve with your wealth.

Is it retiring early funding education or buying a home? Set precise targets with timelines and amounts needed.

This clarity will guide your financial planning from choosing the right investment vehicles to determining your budget and saving strategies.

3. Embracing Investment

Investing is the key to growing your wealth.

Start by diversifying your investments to spread risk and increase potential returns.

Explore different investment options keeping in mind your risk tolerance and time horizon.

Younger investors can generally afford to take more risks given their longer time to recover from any potential losses.

4. The Importance of Saving

Building wealth isn’t just about making money; it’s also about saving it.

Prioritize saving by setting aside a portion of your income before covering your monthly expenses.

Aim to have an emergency fund that covers several months’ worth of income to ensure you’re prepared for any unexpected financial needs.

5. Minimizing Tax Impact

Taxes can significantly affect your wealth-building efforts.

Utilize tax-advantaged accounts like 401(k)s and IRAs to reduce your taxable income and allow your investments to grow tax-deferred or tax-free.

Be strategic about your investment choices and their locations to minimize tax liabilities and maximize your wealth growth.

6. Living Within Your Means

Embracing a lifestyle that’s less about luxury and more about financial wisdom is key.

It’s tempting to splurge on high-end products or lavish vacations but the real magic happens when you focus on essentials.

This approach not only eases financial pressure but also steers you towards investments that grow over time.

Remember consistently spending more than you earn is a surefire way to hinder your financial growth.

7. Debt Management and Credit Building

Taking on debt isn’t inherently bad – it can be a strategic move for acquiring assets like homes or cars or even for starting a business.

The trick lies in managing that debt wisely to ensure it doesn’t derail your wealth-building efforts.

Keep an eye on your debt-to-income ratio and prioritize paying off high-interest debts.

Remember failing to manage debt can hurt your credit score and potentially lead to bankruptcy.

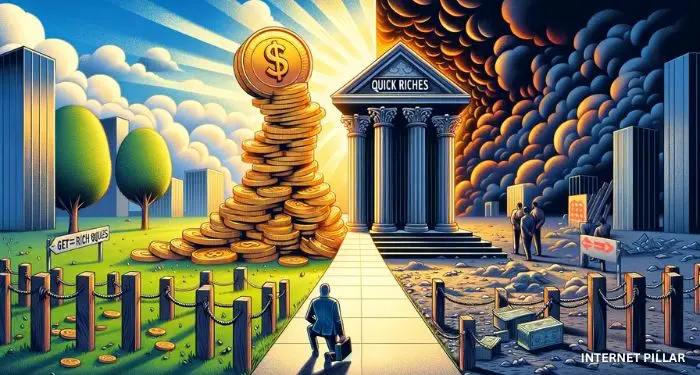

8. Avoid Get-Rich-Quick Schemes

Patience is a virtue in wealth building.

While it’s easy to be lured by the allure of quick returns from trendy investments like cryptocurrencies it’s important to rely on time-tested options like mutual funds or ETFs.

These vehicles offer a balance of risk and reward that’s essential for long-term growth.

Jumping into unproven investments can be more harmful than beneficial.

9. Safeguarding Your Wealth

Insurance plays a critical role in protecting the wealth you’ve worked hard to accumulate.

Unpredictable events from natural disasters to personal tragedies can significantly impact your financial stability.

Investing in insurance be it home auto life or disability insurance is a proactive step to shield yourself and your assets from unforeseen circumstances.

10. Diversifying Your Investments

The investment landscape is fraught with risks but diversification is your best defense.

No investment is foolproof and even seasoned investors can make mistakes.

By spreading your investments across different asset classes and markets you minimize the impact of poor decisions and market volatility on your overall portfolio.

This strategy is about playing the long game ensuring that your wealth-building journey is steady and sustainable.

11. Balance between your Saving and Spending

The concept of saving is deeply rooted in wisdom that values future security over immediate pleasures.

Sacrificing short-term joys for long-term stability is not just about being frugal.

It’s a strategic approach to ensure that essential expenses and investments are not compromised thereby maintaining a healthy lifestyle for you and your family.

12. Continuous Learning

The journey to financial success is paved with knowledge.

Billionaires and successful individuals underscore the importance of continuous learning to stay ahead.

This involves delving into personal finance attending workshops reading extensively and engaging with experts.

Expanding your financial literacy opens doors to better decision-making and opportunity recognition.

13. Having a Strong Network

The strength of your network can influence your access to opportunities.

Building relationships with good individuals can offer insights mentorship and collaboration chances.

having a community of motivated and knowledgeable people can boost your journey towards money.

14. Think Outside the Box

The ability to “think out of the box” and embrace risk sets apart those who achieve extraordinary success.

Innovation and unconventional thinking are important for solving problems and identifying unique opportunities.

Embracing this mindset involves stepping out of comfort zones and being proactive in pursuit of wealth.

15. Budgeting for Clarity and Control

A well drafted budget is the cornerstone of financial management.

It provides a clear overview of your income streams and expenses that helps you in understanding your financial position.

By ensuring that your income surpasses your outgoings, you create room for savings and investments that are important for building and sustaining wealth over long term.

I hope these tips will help you in becoming a wealthy person.