Financial freedom is all about having the freedom to make life choices without worrying about money.

It is about being in control of your finances with no debt, having savings in the bank and investments for the future.

This state of financial peace gives you options and the freedom to help others without stressing about your own bank account.

Achieving financial freedom is not about quick rich scheme but requires hard work, sacrifice and time.

It is a personal journey which involves more than just earning money. It is all about creating a life where money does not limit your choices.

Traditional and new investment strategies can help you on this path.

Financial freedom is attainable for anyone regardless of past financial struggles and involves different meanings for different people.

It is about having complete control over your finances, reducing debt and being able to live the lifestyle you desire.

Some tips and strategic planning can significantly improve your chances of reaching this goal.

Let’s dive in.

15 Proven Steps to Achieve Financial Freedom

1. Master the Art of Budgeting

Getting your finances under control starts with a solid budget.

It is not just about tracking expenses; it’s about planning every dollar’s job before the month kicks off.

Adjust as needed, but always have a plan, regardless of your financial status.

2. Establish Clear Financial Objectives

Dreaming of financial freedom is one thing; setting tangible goals to achieve it is another.

Define specific, measurable goals with deadlines that resonate with you and put them in writing to keep yourself accountable.

3. Choose Your Career Wisely

Your career is a major player in your financial journey.

Opt for a job that not only pays well but also aligns with your long-term goals, offers growth opportunities and supports your pursuit of financial independence.

4. Build an Emergency Fund

Life is full of surprises and an emergency fund is your financial safety net.

Aim to save 3-6 months’ worth of expenses to handle unexpected situations without derailing your financial plans.

5. Invest for Retirement

The sooner you start investing, the better.

Utilize tax-advantaged accounts like 401(k)s and Roth IRAs to grow your retirement savings efficiently, tapping into the power of compound interest.

6. Live Within Your Means

Achieving financial freedom requires discipline.

Spend less than you earn and resist the urge to accumulate debt for short-term gratification.

This mindset is important for long-term financial health.

7. Support Your Kids’ Education

Investing in your children’s education early can set them up for success without the burden of student loans.

Consider Education Savings Accounts and 529 plans as tax-efficient ways to save for their future.

8. Prioritize Your Health

Never underestimate the financial impact of good health.

By maintaining a healthy lifestyle you not only improve your well-being but also reduce potential medical expenses, contributing to your overall financial stability.

9. Get Insurance

Insurance is your financial safety net, guarding against unforeseen events that could jeopardize everything you’ve worked for.

Key policies include term life, auto, homeowners or renters, health, long-term disability, long-term care, identity theft protection and an umbrella policy.

These coverages ensure that your financial freedom remains intact even in the face of life’s uncertainties.

10. Keep Track of Your Spending

To save effectively, you must first grasp your spending habits.

Track every expense for a month to uncover potential savings areas.

Utilize budgeting apps to simplify this process and identify unnecessary expenditures.

11. Know Your Current Financial Situation

Understanding your current financial situation is important, no matter your life stage.

Know your debts, income and any financial gaps, like insufficient insurance or emergency funds.

Acknowledging your starting point, including all debts, is the first step towards financial freedom.

12. Plan For Debt Elimination

Achieving financial freedom often means being debt-free.

Prioritize your debts, focusing on high-interest ones or small balances to gain momentum.

Resist diverting extra funds to investments until high-interest debts are cleared, as this could lead to greater financial strain.

13. Strengthen Your Credit Score

Your credit score is a gateway to favorable loan terms and can influence job opportunities and insurance rates.

Improve your score by reducing debt and ensuring timely bill payments, enhancing your financial stability.

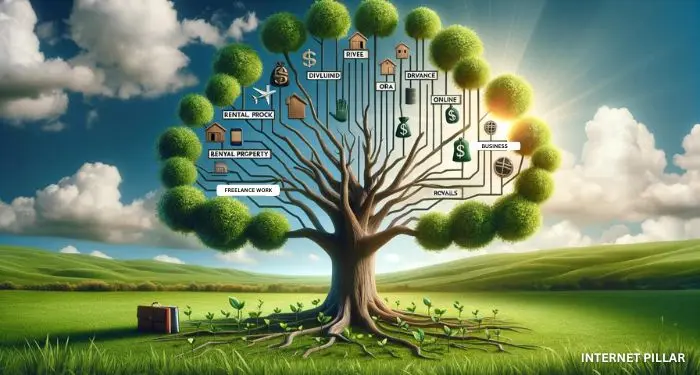

14. Diversify Your Income Streams

Relying solely on a 9-to-5 job may not suffice for true financial freedom.

Explore additional income avenues, both active and passive, to bolster your financial resilience.

Side gigs, freelancing or passive income projects can supplement your primary income.

15. Invest in Experiences Over Material Goods

True fulfillment often stems from experiences rather than possessions.

Reflect on your happiest memories and seek to create more moments that bring genuine joy, rather than accumulating material items that offer fleeting satisfaction.

So these were some of the steps you can take to achieve Financial Freedom.